August 4, 2022

by Ethan Gilbert

This famous quote by Warren Buffet is one of the most well-known quotes related to investing. At its core is the idea that investors’ emotions betray them, and it pays to be contrarian. When the market is up, people feel good about investing and want to “get in.” On the other hand, when the market is significantly down and people have had bad recent experiences in the markets, most want to get out or are hesitant to put new money in. Unfortunately, these normal urges are harmful to investors.

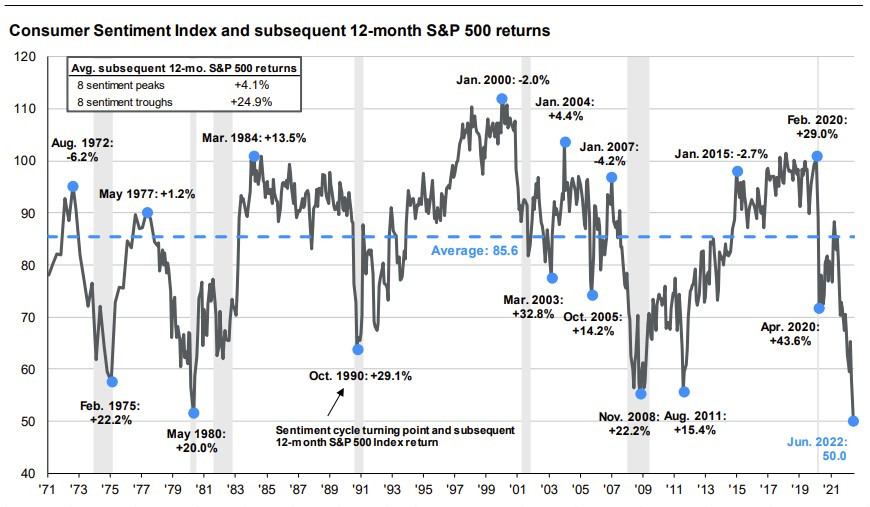

While it makes sense on the surface, wouldn’t it be nice to have data to confirm the theory? Luckily, we do! The following chart shows 50 years’ worth of peaks and troughs of consumer sentiment and the subsequent 12-month return of the S&P 500.

Over the last 50 years, we can see 8 different peaks in consumer sentiment and different 8 troughs. When the population feels most confident about the economy, the stock market returns over the ensuing 12 months average 4%. When consumers feel the most pessimistic about the economy, the ensuing 12 months see a 25% return from stocks on average.

Unfortunately for our psyche, the state of the economy is making us feel nervous. Fortunately for our wallets, this has been an indicator of strong future performance. There is no guarantee this phenomenon will happen again and no guarantee this month’s reading of 50.0 will be the low, but it’s likely that things will eventually improve, they always have.

Be Fearful when Others are Greedy, and Greedy when Others are Fearful – A Quantitative Examination

August 4, 2022 by Ethan Gilbert

This famous quote by Warren Buffet is one of the most well-known quotes related to investing. At its core is the idea that investors’ emotions betray them, and it pays to be contrarian. When the market is up, people feel good about investing and want to “get in.” On the other hand, when the market is significantly down and people have had bad recent experiences in the markets, most want to get out or are hesitant to put new money in. Unfortunately, these normal urges are harmful to investors.

While it makes sense on the surface, wouldn’t it be nice to have data to confirm the theory? Luckily, we do! The following chart shows 50 years’ worth of peaks and troughs of consumer sentiment and the subsequent 12-month return of the S&P 500.

Over the last 50 years, we can see 8 different peaks in consumer sentiment and different 8 troughs. When the population feels most confident about the economy, the stock market returns over the ensuing 12 months average 4%. When consumers feel the most pessimistic about the economy, the ensuing 12 months see a 25% return from stocks on average.

Unfortunately for our psyche, the state of the economy is making us feel nervous. Fortunately for our wallets, this has been an indicator of strong future performance. There is no guarantee this phenomenon will happen again and no guarantee this month’s reading of 50.0 will be the low, but it’s likely that things will eventually improve, they always have.

Rialto Wealth Management is a fee-only, fiduciary, advisory firm based in Syracuse, NY. From financial planning to investment management, we help families across New York and beyond. We can be reached by phone at (315) 992-9129 or via email through our website’s secure and confidential contact page.